Federal Tax Rate On Bonuses 2025. If you receive your bonus and regular wages in one pay. Perentage bonus fixed amount bonus.

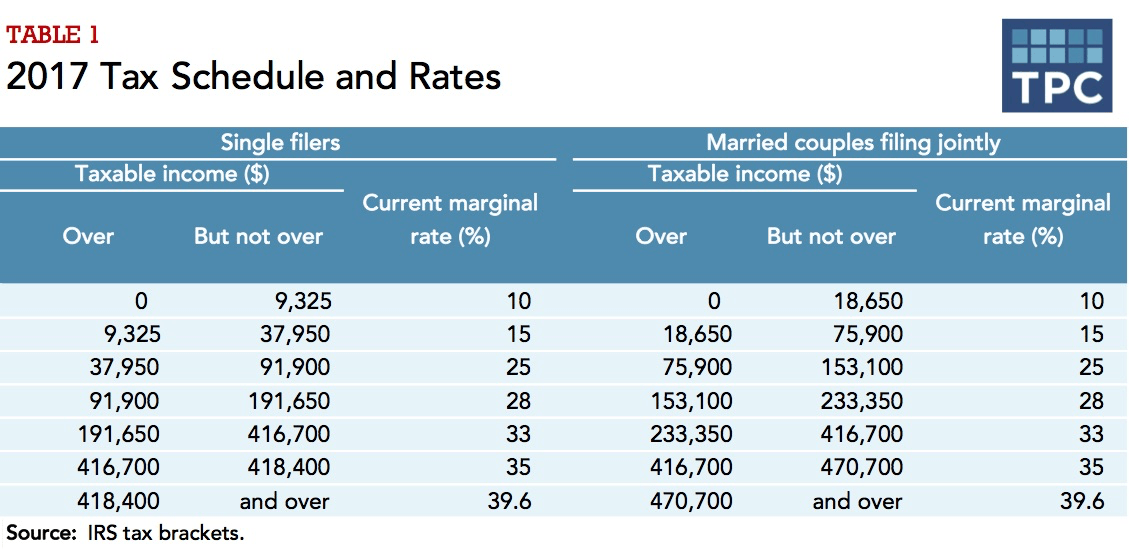

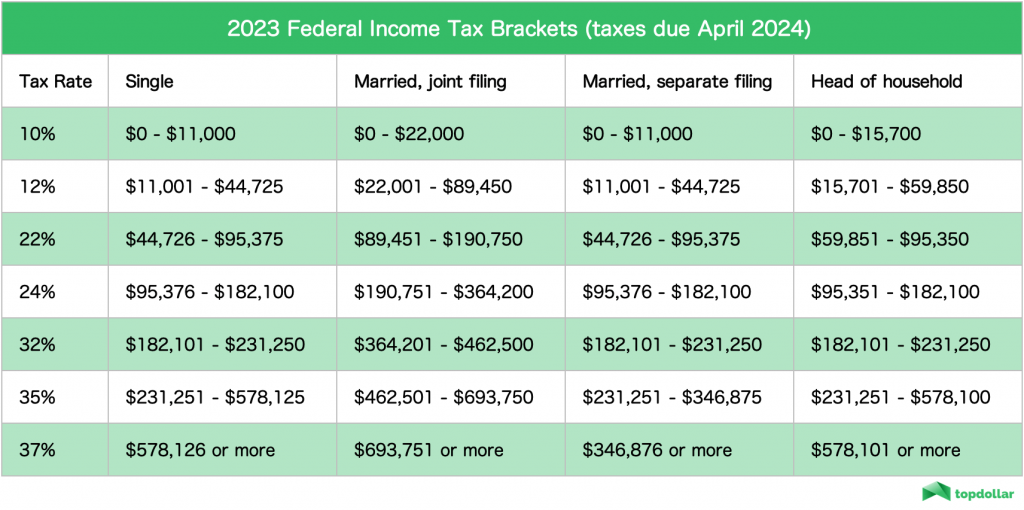

In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

2025 tax brackets (taxes due in april 2025) the 2025 tax year, and the return due in 2025, will continue with these seven federal tax brackets:

Tax rates for the 2025 year of assessment Just One Lap, In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Her employer withholds 22% of the first $1m and an additional 37% on the remaining $300,000.

50 Shocking Facts Unveiling Federal Tax Rates in 2025, It uses the percentage method, which applies a flat percentage rate of 22% to bonuses under $1 million and a 37% rate to any portion exceeding $1 million. Bonuses are taxed at ordinary income rates but the government may initially withhold more money than usual.

20242024 Tax Calculator Teena Genvieve, Generally, the 2025 federal bonus tax rate is a 22% flat rate if employers withhold taxes using the percentage method. In another example, jane receives a $1.3m bonus.

Here are the federal tax brackets for 2025 vs. 2025 Narrative News, For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly). Enter your salary in north carolina.

Tax Rates 2025 To 2025 2025 Printable Calendar, How do employee bonus taxes work? Bonuses are taxed at ordinary income rates but the government may initially withhold more money than usual.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, This brings john’s total federal tax withholding on his bonus to $770. In this comprehensive guide, we'll explore the 2025 bonus tax rate and demystify the intricacies of how bonuses are taxed, providing you with the knowledge.

T130159 Baseline Distribution of and Federal Taxes; by, Employees whose total bonus payments exceed $1 million in a calendar year are subject to higher. Page last reviewed or updated:

Fed Tax Schedule For 2025 Cleveland Indians Schedule 2025, Employees whose total bonus payments exceed $1 million in a calendar year are subject to higher. At the time of receipt of your bonus, federal taxes are typically withheld by your employer that can be at ahigher tax.

T200018 Baseline Distribution of and Federal Taxes, All Tax, How bonus tax withholding works. In addition to federal withholding, you will also likely need to have taxes withheld for medicare and social.

/2016-Federal-Tax-Rates-57a631ca3df78cf459194b33.png)

What Percentage Of Is Federal Tax, In addition to federal withholding, you will also likely need to have taxes withheld for medicare and social. In 2025 and 2025, there are seven federal income tax rates and brackets: